Getting a Debt Consolidation Loan with Bad Credit

If you are struggling through debt, you’ve probably considered debt consolidation as a relief option. Even though a bit controversial, it is a great way to save and get out of debt quickly. While debt consolidation is generally considered to be available only to borrowers with good to excellent credit score, it is also an option for those with poor credit.

However, borrowers with poor credit should take extra precaution since one wrong move can push them further into debt and damage their credit score. This post will cover the following areas:

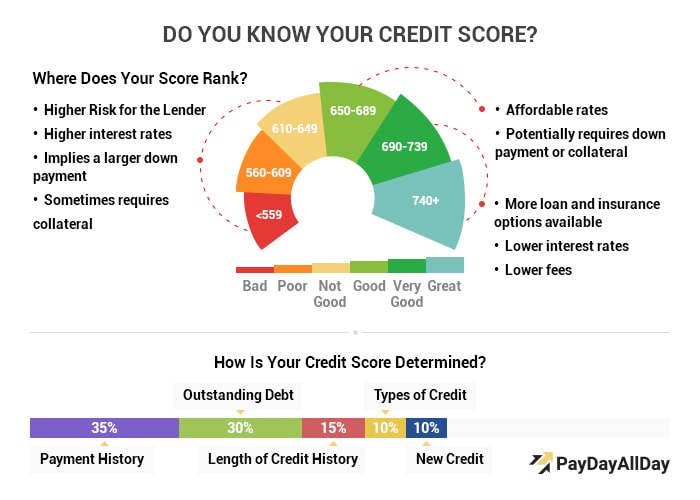

A poor credit score means that you are a risky borrower and therefore must pay a premium if at all you are to get a loan.

A poor credit score means that you are a risky borrower and therefore must pay a premium if at all you are to get a loan.

So, what we were trying to show was: The Comparison of Bad Credit Loan and Good Credit Loan. The table shows that you can save $218.59 a month or $13 115.55 in total savings which a big difference. How to make it? You can do it by repairing your bad credit.

- What a poor credit score means to lenders.

- Shopping around for the best deals.

- Secured or unsecured debt consolidation?

- Beware of debt consolidation scams.

What a Poor Credit Score Means to Borrowers

A borrower’s credit score is among the most critical metrics in the determination of default risk. Your credit score is likely to suffer if you have:- late payments or miss payments,

- a high credit utilization ratio,

- many accounts with a balance,

- a short credit history,

- negative information on your credit report.

A poor credit score means that you are a risky borrower and therefore must pay a premium if at all you are to get a loan.

A poor credit score means that you are a risky borrower and therefore must pay a premium if at all you are to get a loan.

The Comparison of Bad Credit Loan and Good Credit Loan

Example: Loan details:- Loan amount: $15 000

- Loan term: 5 years (or 60 months)

- Good credit: 6.00%

- Bad credit: 32.50%

| Repayments | Daily | Monthly | Annually | Life of loan |

| Good credit: | $9.51 | $289.99 | $3,560.95 | $17 399.52 |

| Bad credit: | $16.62 | $508.58 | $6,455.77 | $30 515.07 |

| Extra interest: | $7.11 | $218.59 | $2 894.82 | $13 115.55 |

Can I Get a Low-Interest Debt Consolidation Loan for Bad Credit?

While good deals may be hard to come by, it is possible to find a debt consolidation loan that helps you save on interest payments without requiring a good credit score. However, such offers are likely not to be as attractive as those offered to borrowers with good to excellent credit. Also, you will need to shop around relentlessly and patiently to identify meaningful offers. Remember that a wrong choice taken out of desperation is likely to cost you more in the long run.What You Need to Consider Before Applying for a Debt Consolidation Loan for Bad Credit

Before you take a debt consolidation loan for bad credit, there are some things that you need to consider.1. Determine your preparedness to meet monthly payments

As mentioned earlier, taking a debt consolidation loan without a clear payment plan can result in more harm than good. Before you make an application, determine your preparedness to pay and also the discipline to keep away from taking up more debt before the consolidated debt is paid fully. Ensure that you have a budget for the payments and use an online loan calculator to determine the maximum you can afford to pay per month without straining. Consider alternative options if you cannot find a loan that fits your budget.2. Ensure that you are disciplined enough not to take other loans before

Debt consolidation means moving all your debts including credit cards into one loan. If you are not a disciplined borrower, having debt free cards after consolidation may tempt you to take up more debt. If you can’t control your borrowing appetite, it is only better that you keep away from consolidation loans.3. Read the fine details in each offer

It is also essential that you read the fine details in each offer to avoid shocking surprises later. Some offers may have desirable but still be not a good option due to high fees.4. Avoid making too many hard inquiries

Another thing worth noting is the impact that hard inquiries have on your credit score. Ensure that you do your research well before applying to minimize the chances of having too many inquiries.5. Evaluate alternatives to debt consolidation

Finally, evaluate the alternatives to debt consolidation to determine if there are other cheaper and easier ways to manage your debt. Possible options include a debt management plan, Home Equity Loans, Cash-Out Refinance, and Debt Settlement.Types of Consolidation Loans for Bad Credit

| Unsecured Debt Consolidation for bad credit | Secured Debt Consolidation for bad credit | Loans with a co-signer |

|

|

|

Shopping Around for the Best Deals

If this is your first time with debt consolidation for bad credit, then it is highly likely that you do not know where to get started. First, you need to know that not all companies are suited for borrowers with bad credit. Going for the wrong company is likely to lead to rejections or ridiculous offers. Interests on debt consolidation loans for bad credit can be as high as 40 percent, and therefore it is vital that you way the cost-benefit first before you settle on an offer. Some loans may also have a lower APR but a more extended repayment period which means that you might be paying more interest in the long run. Loan finder services are the best place to start looking for debt consolidation loans for bad credit offers and comparing terms. LendingTree.com, Credible, and Even Financials are some of the platforms you can use to identify the best offers in the market.Final Word

Debt consolidation with a bad credit score is possible, but it takes time and effort. Before you commit yourself to any offer, ensure that you have all the fine details and have evaluated your ability to make payments as required.Customer Notice

We strive to provide accurate information regarding personal finance and debt management, but it may not apply to an individual’s situation directly. This content is for informational purposes only and should not be considered as financial advice. PayDayAllDay.com won’t bear any responsibility in relation to personal decisions made based on it. You should consult your financial or tax advisor before making any financial decisions.

References and Sources

1. A Financial Intelligence Platform that Helps You Do More. Lending Tree, LLC. Available at https://my.lendingtree.com/enroll

2. Thomas (TJ) Porter (2018). How to Fix a Bad 300-560 Credit Score. Mybanktracker.Com. Available at https://www.mybanktracker.com/credit-cards/credit-score/how-fix-very-bad-credit-score-254021

3. Lender Network. Consolidation Loans for Bad Credit. Thelendersnetwork.Com. Available at https://thelendersnetwork.com/debt-consolidation-loans-for-bad-credit/

4. Your Honest Source For Comparing Rates. Credible Labs Inc. Available at https://www.credible.com/

5. Powering Financial Services Online. Evenfinancial.Com. Available at https://evenfinancial.com/

6. Sarita Harbour. Credit Score Ranges: What Do They Mean? Investopedia.Com. Available at https://www.investopedia.com/articles/personal-finance/081514/what-do-credit-score-ranges-mean.asp

Alice was born and raised in Compton, California. Then she studied at Yuin University, the place where she became passionate about researching the thin ropes between money and meaning. She is insatiably interested in people’s potential, wondering why some succeed and others don’t. Thus, the articles on her blog explore a multitude of seemingly unconnected things: money, psychology, entrepreneurship, creativity, spirituality, philanthropy, just to name a few.